Why Your W-4 Determines Your Take-Home Pay

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

How and Why to Adjust Your Tax Withholding Before the Year Ends

If you’re reading this, chances are you’ve noticed something off about your take‑home pay this year. Whether you’re getting a large tax bill next spring or are surprised by a hefty refund, the solution may lie in tweaking your withholding— and doing it before the calendar flips. The Investopedia piece “Change your tax withholding before the year ends” walks readers through exactly why and how to make that adjustment, using practical examples and up‑to‑date tools from the IRS. Below is a concise, yet thorough, summary of the article’s key takeaways.

1. The Basics: What Is Tax Withholding?

At the heart of the discussion is the W‑4 form— the worksheet your employer uses to determine how much federal income tax to pull from each paycheck. The IRS requires that the amount withheld roughly matches your final tax liability. If you withhold too little, you’ll owe money—and potentially a penalty—when you file. If you withhold too much, you’ll receive a refund that could have been used for other priorities.

The article notes that withholding isn’t just about the federal tax; it also affects state taxes, Social Security, and Medicare. Many employers automatically include state withholding, but you’ll still need to account for it when estimating your total liability.

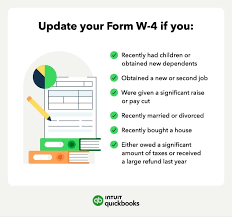

2. When Should You Consider an Adjustment?

The Investopedia piece emphasizes two “pivot points” during the year:

| Timing | Why Adjust |

|---|---|

| Mid‑year | After a significant life change (marriage, new child, new job, major home purchase). These events alter your deductions and the number of dependents you can claim. |

| Late‑year | Once you receive your first or second W‑2 and have a rough sense of your annual income and deductions. This is the ideal moment to avoid a year‑end surprise. |

The article argues that adjusting before the year ends is usually the safest strategy. If you wait until after filing, you might face a hefty tax bill with no way to spread the cost.

3. Why Most People Get It Wrong

A core point of the article is that many taxpayers over‑estimate their tax liability— a common reason for large refunds. Common misconceptions include:

- Standard deduction vs. itemized: Not everyone knows that if you’re over the standard deduction threshold, you should itemize. Failing to do so results in over‑withholding.

- Other sources of income: Self‑employment earnings, dividends, or rental income aren’t factored into your W‑4 unless you use a supplemental worksheet.

- Multiple jobs: If you hold two or more part‑time positions, each employer’s calculation can push you into a higher withholding bracket.

Because of these pitfalls, the article stresses the importance of a tax withholding calculator.

4. How to Use the IRS Tax Withholding Estimator

The Investopedia article links directly to the IRS’s own online tool, the Tax Withholding Estimator. Here’s the step‑by‑step process the article outlines:

- Gather Documents: You’ll need your latest W‑2, an estimate of other income, and any last year’s tax return.

- Input Data: The estimator asks for filing status, dependents, expected deductions, and whether you’ll claim the standard deduction.

- Answer Employment Questions: If you have multiple jobs, the tool will prompt for the pay amounts for each.

- Generate Recommendations: The estimator will tell you how many more or fewer dollars to withhold per paycheck.

The article stresses that the calculator is “highly accurate” but that it’s wise to double‑check using your own records or a spreadsheet.

5. Submitting a New W‑4

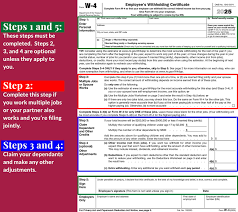

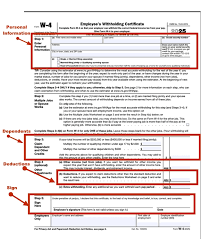

Once you know the adjustment you need, the next step is straightforward: submit a new W‑4 to your payroll department. The article includes a handy visual of the form’s most important sections:

- Line 1: Filing status and number of dependents.

- Line 3: Additional amount you want withheld each pay period.

- Line 4: Optional. If you have significant other income, you can enter it here to raise withholding.

A common question the article answers is whether you can adjust “by the end of the year” and still receive a revised pay. The answer: yes— as soon as your employer processes the new W‑4, it takes effect for the next paycheck. Many companies allow you to submit it online via their HR portal.

6. Special Situations

The article devotes a section to special circumstances that often trip up taxpayers:

| Scenario | Recommended Action |

|---|---|

| Self‑employment | Make estimated quarterly payments; consider adding a line to your W‑4 for additional withholding. |

| High‑deduction mortgage interest | Itemize on Schedule A; adjust withholding accordingly. |

| Marrying or divorcing | Update filing status and dependents on the W‑4 immediately. |

| Receiving a bonus or commission | Estimate the tax impact and add a separate withholding if needed. |

Each case includes a short example illustrating how the withholding amount changes.

7. The Bottom Line: Avoid a Big Tax Bill

In a final, succinct recap, the article reminds readers that the core goal of withholding is to avoid a “tax shock.” A large refund indicates that you’ve over‑paid, essentially giving the government a free interest‑free loan. Under‑withholding, on the other hand, can trigger a penalty and leave you scrambling for cash in January. By using the IRS estimator, updating your W‑4 promptly, and staying aware of life changes, you can keep your paycheck stable and your taxes predictable.

8. Resources and Further Reading

At the end of the Investopedia article, several links provide deeper dives:

- IRS Tax Withholding Estimator (direct link to the tool).

- Publication 505 – Tax Withholding and Estimated Tax.

- W‑4 Worksheet – downloadable PDF with step‑by‑step instructions.

- Estimated Tax – For Self‑Employes – a guide on quarterly payments.

These resources help reinforce the steps and ensure you have the official IRS guidance at hand.

Final Thoughts

Changing your withholding before the year ends isn’t just about avoiding penalties—it’s about financial planning. By using the IRS estimator, adjusting your W‑4 thoughtfully, and keeping an eye on major life events, you can make sure that each paycheck reflects your actual tax liability. That way, the next spring can be free of surprise tax bills or overly generous refunds, leaving you more control over your cash flow.

Read the Full Investopedia Article at:

[ https://www.investopedia.com/change-your-tax-withholding-before-the-year-ends-11850705 ]