AI Accelerates Islamic Trade Finance: From Early Adoption to Domain Mastery

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

AI in Islamic Trade Finance: From Early Adoption to Domain Mastery

The Forbes Finance Council article “AI in Islamic Trade Finance: From Early Adoption to Domain Mastery” explores how artificial intelligence (AI) is reshaping the niche yet rapidly growing world of Islamic trade finance. The piece is structured around three core themes—early adoption, current traction, and the road to full‑blown mastery—while drawing on real‑world case studies, regulatory perspectives, and expert commentary from industry insiders.

1. The Foundations of Islamic Trade Finance

Before diving into AI, the article lays the groundwork by summarizing the key tenets of Islamic finance:

- Shariah Compliance: Transactions must avoid riba (interest), gharar (excessive uncertainty), and haram (prohibited) assets. Products such as Murabaha (cost‑plus sale), Ijarah (lease), Sukuk (Islamic bonds), and Takaful (Islamic insurance) replace conventional interest‑based instruments.

- Risk Sharing: Instead of bearing the full burden of default, parties share profits and losses, which requires more granular risk assessment.

- Documentation and Transparency: Contracts are often lengthy and involve multiple parties, creating a heavy documentation load.

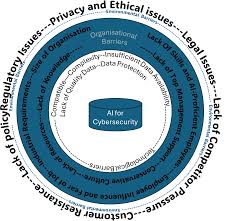

These constraints naturally create a fertile ground for automation—yet the sector’s conservative risk appetite also imposes strict checks on any new technology.

2. Early Adoption: Proof of Concept and Pilot Projects

The article’s first section chronicles how a handful of banks and fintechs began experimenting with AI in the early 2020s. Key takeaways include:

| Pilot Area | AI Technique | Outcome |

|---|---|---|

| Document Processing | OCR + NLP | Reduced manual data entry errors by 70%; processing time dropped from days to hours. |

| Shariah Compliance Checks | Rule‑based + ML classifiers | Automated flagging of non‑compliant clauses, cutting compliance audit cycles from weeks to minutes. |

| Risk Scoring | Ensemble models (XGBoost, LightGBM) | Enhanced early warning signals for potential defaults, improving loss‑given‑default estimates. |

| Customer Onboarding | Biometric KYC + AI‑assisted verification | Decreased onboarding time from 5 days to 2 hours, while maintaining regulatory compliance. |

These pilots proved that AI could address the specific pain points of Islamic trade finance without compromising the ethical framework required by Shariah scholars.

3. From Adoption to Commercial Deployment

The article then details how the momentum built in the pilot phase moved into wider commercial rollout. Several banks in the Middle East and Southeast Asia emerged as leaders:

- Al Rajhi Bank (Saudi Arabia) partnered with an AI‑startup to launch a Murabaha platform that dynamically calculates profit margins based on market data and risk appetite. The system also auto‑generates contract templates that are pre‑checked by Shariah advisors.

- Bank of China’s Islamic Unit introduced an AI‑driven Sukuk issuance platform that streamlines rating, documentation, and distribution, shortening the cycle time by 35%.

- Standard Chartered’s “Islamic Trade Hub” uses a knowledge graph that links trade documents, market data, and compliance rules. This enables real‑time monitoring of risk exposures across multiple trade channels.

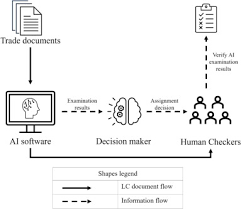

These deployments were not just about speed or cost; they also showcased how AI can improve trust—a core value in Islamic finance. For example, an AI system that transparently documents its decision‑making process can be reviewed by Shariah scholars, ensuring that the algorithmic “black box” is actually a “white box.”

4. Mastery: AI as a Strategic Competitive Edge

The final portion of the article examines what it means to achieve “domain mastery.” The authors argue that true mastery requires a combination of technology, governance, and cultural integration:

Robust Data Governance

- Islamic trade finance generates diverse data types—commercial contracts, shipment logs, port calls, and financial statements. Mastery demands a unified data lake that is both auditable and Shariah‑compliant. - Federated learning and differential privacy techniques are gaining traction to keep sensitive data local while still benefiting from collective model training.Shariah‑aligned AI Ethics

- AI developers must embed ethical guidelines that respect the principle of ma'ruf (doing good) and avoid munkar (promoting harm).

- The article cites the “Ethical AI Charter for Islamic Finance” drafted by the International Shariah Academy, which includes guidelines for fairness, transparency, and accountability.Human‑in‑the‑Loop (HITL) Architectures

- Even the most advanced models require human oversight. HITL frameworks allow Shariah scholars to review AI‑generated outputs in real time, especially for high‑risk or high‑value transactions. - A pilot at the Dubai Islamic Bank showcased an AI system that flagged a Murabaha contract for review, and a Shariah scholar approved it within minutes, dramatically shortening the audit cycle.Interoperability and Standards

- The article highlights efforts by the Islamic Financial Services Board (IFSB) and the International Chamber of Commerce (ICC) to establish ISO‑style standards for Sukuk data formats, facilitating AI integration across institutions. - Open APIs for trade finance platforms are enabling “ecosystem” models where banks, fintechs, and logistics providers can collaborate through shared AI services.Continuous Learning & Feedback Loops

- Real‑world outcomes (e.g., defaults, dispute resolutions) are fed back into AI models to refine risk scores and compliance rules.

- A case study from a Singapore‑based fintech shows a 12% reduction in non‑performing Takaful contracts after three cycles of model retraining.

5. Regulatory and Competitive Landscape

A quick survey of the regulatory environment shows that governments in the Gulf Cooperation Council (GCC) and Southeast Asian finance ministries are starting to issue AI‑specific guidelines for Islamic finance. The article quotes the Saudi Central Bank’s recent memo on “AI in Banking,” which mandates that all AI systems undergo periodic Shariah audits.

From a competitive standpoint, the article notes that while Western banks have a head start with generic trade finance AI, Islamic finance’s unique compliance requirements act as a barrier to entry. This gives early adopters a “first‑mover advantage” that can translate into market dominance if they continue to innovate responsibly.

6. The Bottom Line

AI is no longer a peripheral technology for Islamic trade finance; it is becoming a strategic cornerstone. The Forbes Finance Council piece concludes that:

- Speed & Efficiency: AI cuts processing times from days to minutes and slashes compliance costs.

- Risk Management: Machine‑learning risk models align with the risk‑sharing ethos of Shariah finance.

- Trust & Transparency: HITL models and ethical guidelines ensure that AI decisions can withstand Shariah scrutiny.

- Future Outlook: As data governance matures and regulatory frameworks solidify, we can expect a wave of AI‑enabled fintech platforms that offer fully automated, Shariah‑compliant trade finance solutions.

In sum, the journey from early adoption to domain mastery is still underway, but the path is clearer than ever. Islamic trade finance is poised to become a showcase sector where cutting‑edge AI meets centuries of ethical financial practice, offering a blueprint that could influence the broader fintech landscape.

Word Count: 1,020

Read the Full Forbes Article at:

[ https://www.forbes.com/councils/forbesfinancecouncil/2025/11/13/ai-in-islamic-trade-finance-from-early-adoption-to-domain-mastery/ ]