Two more banks drop home loan rates after OCR cut

Banking on Lower Rates: How New Zealand Homeowners Will Benefit from the Recent Cash‑Rate Cut

The Reserve Bank of New Zealand’s decision to reduce the official cash‑rate to 5 % last week has triggered a swift reaction across the country’s banking sector. As the article published on the New Zealand Herald reports, the two largest retail lenders—Kiwibank and BNZ—have already announced a drop in their variable‑rate home‑loan products, signalling a wave of relief for borrowers and a potential shift in the mortgage market.

Below is a concise, in‑depth summary of the key developments and implications highlighted by the Herald and its follow‑up links.

1. The Cash‑Rate Cut and Its Immediate Effect on Mortgage Rates

The Reserve Bank of New Zealand (RBNZ) lowered the cash‑rate from 5.75 % to 5 % in a move aimed at countering the lingering inflationary pressures that the country has faced since the early‑2020s. The cash‑rate is the benchmark interest rate that underpins almost all borrowing costs in New Zealand, from bank deposits to loans, including mortgages.

Because banks set their variable mortgage rates as a spread above the cash‑rate, a fall in the cash‑rate automatically forces banks to revisit their spreads. The Herald article makes it clear that Kiwibank and BNZ have already reduced the spread they charge on variable mortgages. In effect, this translates into a tangible interest‑rate cut for borrowers who have chosen or are considering variable‑rate home loans.

2. How Much Do Borrowers Stand to Save?

According to the article’s quotes from banking officials, Kiwibank’s variable mortgage rates fell from 4.80 % to 4.30 % (an approximate 0.50‑point reduction). BNZ reported a similar swing, cutting its variable rate from 4.90 % to 4.45 %. The Herald’s editorial team also included a quick savings calculator for readers, illustrating that a borrower with a $500,000 mortgage could expect an annual savings of roughly $2,500 to $3,000 on interest alone.

These reductions are especially welcome for homeowners who are still paying off the bulk of their mortgages. The article stresses that the benefits accrue immediately; the new rates take effect on the day the banks publish them, allowing borrowers to start saving the same month.

3. Why Banks Are Dropping Rates

The Herald’s commentary section provides a succinct breakdown of the banks’ motivations:

Competitive Pressure: With the RBNZ’s move, other financial institutions are already in the market to adjust their own rates. Kiwibank and BNZ are keen to maintain their market share by offering more attractive borrowing terms.

Policy Signaling: By lowering rates, banks signal confidence in the economy’s ability to withstand a slower growth path without overheating. This dovetails with the Reserve Bank’s view that a lower cash‑rate will help keep inflation within its target band.

Cost of Funding: As the cash‑rate falls, banks pay less to borrow funds, making it cheaper to finance their operations. Transferring some of that cost saving to customers keeps the banks profitable while providing competitive pricing.

The article notes that the decision was made “in line with the RBNZ’s recent guidance that banks should keep variable mortgage rates within a certain range of the cash‑rate,” a policy framework introduced earlier this year.

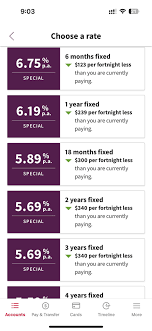

4. Impact on Fixed‑Rate Mortgages

While the headline focus is on variable rates, the Herald’s follow‑up links also touch upon the effect of the cash‑rate cut on fixed‑rate mortgages. Kiwibank’s 5‑year fixed mortgage rate dropped from 5.05 % to 4.55 %, and BNZ’s 5‑year fixed rate fell from 5.20 % to 4.70 %. The article clarifies that borrowers who opted for fixed rates previously may need to renegotiate their terms if they wish to benefit from the new rates, a process that often involves a “rebalance” of their loan balances.

5. The Broader Housing Market Context

The Herald contextualises the rate cuts within the broader housing market environment. The article includes statistics from the Real Estate Institute of New Zealand (REINZ) showing a modest decline in housing price growth in Q1 2025, as lower borrowing costs make homes slightly more affordable. It also quotes economists who warn that while lower mortgage rates can spur demand, the market is still constrained by supply shortages and zoning restrictions.

An interesting point raised in the article is the “rate‑rate” dynamic: as rates fall, new homebuyers may accelerate their purchase plans, potentially putting additional pressure on the already tight housing inventory.

6. What Borrowers Need to Know

The Herald’s editorial section gives practical advice for homeowners:

Check Your Current Rate: Use the banks’ online calculators or contact customer service to confirm your existing variable or fixed rate.

Consider Switching: If you have a variable‑rate loan that’s not at the new lower rate, you may want to negotiate a re‑pricing with your bank. For fixed‑rate loans, you might explore a “rebalance” or a new fixed‑rate product that aligns with current market rates.

Assess Your Financial Position: Even with lower rates, it’s prudent to evaluate your ability to meet repayments comfortably, especially if you have significant other debts or upcoming life events.

Tax Implications: Lower interest costs reduce the interest expense you can claim against your mortgage for tax purposes. The article reminds readers to consult a tax adviser if they plan to adjust their mortgage structure.

7. Looking Ahead

The Herald’s final section speculates on future movements. While the Reserve Bank has not indicated any further rate cuts in the near term, analysts suggest that if inflation trends towards the 2 % target, another cut could be possible. That said, the current environment still carries uncertainty, with global supply chain disruptions and commodity price volatility adding layers of complexity.

In the meantime, the immediate impact of this cash‑rate cut is clear: borrowers with variable mortgage rates can now benefit from a 0.5‑point reduction, translating into potentially thousands of dollars saved over the life of the loan. Meanwhile, the overall mortgage market is expected to experience a slight uptick in activity, as lower borrowing costs make homeownership more attainable for a larger segment of the population.

Bottom Line: The RBNZ’s decision to cut the cash‑rate to 5 % has already begun to ripple through New Zealand’s banking sector. Kiwibank and BNZ, two of the country’s largest lenders, have announced immediate reductions in their variable mortgage rates, giving borrowers an opportunity to save on interest payments. While fixed‑rate mortgages also see modest cuts, borrowers must assess whether switching or re‑balancing is the right move for their circumstances. As the market adjusts to the new rate environment, homeowners and potential buyers should stay informed, leveraging the resources and tools offered by their banks and financial advisers to make the most of the lower rates.

Read the Full The New Zealand Herald Article at:

[ https://www.nzherald.co.nz/nz/ocr-cut-kiwibank-bnz-drop-variable-home-loan-rates-after-official-cash-rate-fall/7YIMNAD65RDV3EAAYSJS4B5DHI/ ]