Microfinance sector under scrutiny as NGOs push for tiered regulation

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

Ghana’s Micro‑Finance Landscape Faces Regulatory Overhaul as NGOs Urge Tiered Approach

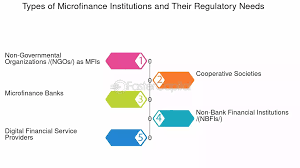

The micro‑finance sector in Ghana is at a crossroads. A wave of scrutiny from the government has been met with an organized push from non‑governmental organisations (NGOs) that argue a “tiered” regulatory system would better serve the industry and its clients. The debate—spanning from the Bank of Ghana’s policy brief to grassroots advocacy forums—centers on how best to balance innovation, financial inclusion, and risk control in an environment that has seen rapid growth in both traditional micro‑finance institutions (MFIs) and fintech‑driven lenders.

1. The Current Regulatory Landscape

Under the present legal framework, MFIs operate under a dual system. First, they are regulated by the Bank of Ghana (BoG) through the Non‑Banking Financial Institutions (NBFI) Act, which imposes prudential standards, capital adequacy requirements, and mandatory reporting. Second, the Ghana Deposit Insurance Corporation (GDIC) offers deposit insurance to MFIs’ clients, thereby protecting the latter against insolvency. However, many NGOs, including the Ghana Microfinance Association (GMA) and the Ghana Women’s Micro‑Finance Initiative (GWMI), argue that this structure is overly restrictive for smaller MFIs and insufficient for larger ones that pose systemic risks.

The BoG’s recent policy brief—highlighted in a GhanaWeb article—concludes that while the current regime has achieved notable financial inclusion, it has left gaps. “The proliferation of ‘shadow’ lenders and the rise of fintech disruptors mean the one‑size‑fits‑all model no longer works,” the BoG’s Deputy Governor, Dr. Kwame Nkrumah, said during a press briefing.

2. NGOs Push for Tiered Regulation

In response, NGOs have coalesced around a tiered regulatory framework that would categorize MFIs based on three criteria: capital size, risk profile, and service mix. Under this model:

- Tier 1 would include the largest MFIs (assets > GHS 500 million) and would be subject to the most stringent prudential rules, periodic on‑site inspections, and higher capital buffers.

- Tier 2 would capture medium‑sized institutions (assets between GHS 100 million and GHS 500 million), subject to moderate requirements, and would be required to maintain a minimum reserve ratio.

- Tier 3 would encompass small‑scale, community‑based MFIs (assets < GHS 100 million), which would enjoy simplified reporting and lower capital thresholds, but would be mandated to implement robust internal controls and consumer protection protocols.

The NGOs claim that such segmentation would preserve financial inclusion—particularly for rural communities—while curbing the risk of widespread defaults. “We are not advocating for deregulation, but for regulation that matches the scale and risk of each institution,” said Joyce Agyemang, director of GWMI. “The ‘one‑size‑fits‑all’ model is a relic of the 1990s.”

The proposed framework aligns with the International Monetary Fund (IMF) and World Bank guidelines on NBFI regulation, which emphasize a risk‑based approach. In a joint statement with the International Finance Corporation (IFC), the Ghanaian Ministry of Finance acknowledged the need to “harmonize prudential standards with the realities of small‑scale lenders.”

3. Key Concerns and Counter‑Arguments

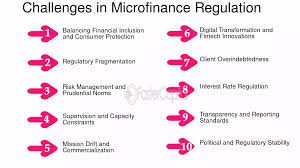

Risk Management: Critics argue that a tiered system could create a two‑tiered market where larger MFIs enjoy more regulatory scrutiny, potentially stifling their growth. “If smaller MFIs are not held to the same standards, they could accumulate hidden risk,” warned Samuel Mensah, a senior analyst at the Ghana Institute of Financial Studies.

Consumer Protection: NGOs highlight that many MFIs operate in remote areas where financial literacy is low. Tiered regulation would require mandatory financial education programs and stricter interest‑rate caps, especially for Tier 3 institutions that often charge above the statutory maximum of 36 % per annum.

Implementation Challenges: Some MFIs fear that additional reporting burdens could jeopardize their survival. Esi Osei, CEO of the rural MFI AgroFinance, expressed concerns that compliance costs would outweigh the benefits, especially for small, family‑run institutions.

Government Stance: The BoG, while acknowledging the NGOs’ points, remains cautious. The Governor’s office stated that any regulatory overhaul would need a consultative process involving all stakeholders—including the private sector, civil society, and international partners—to ensure “equitable implementation.” The BoG has also proposed a pilot phase in the Ashanti and Northern regions to test the tiered model before a national rollout.

4. Wider Implications for Financial Inclusion

The micro‑finance sector has been pivotal in Ghana’s push toward universal financial inclusion. According to the World Bank’s Global Findex data, micro‑finance penetration accounts for nearly 30% of the country’s underbanked population. A tiered regulatory regime could safeguard this progress by preventing systemic shocks while encouraging innovation.

Fintech players, who have recently surged with mobile money services, also stand to be affected. The Bank of Ghana’s Fintech Regulatory Framework—launched in 2022—already imposes licensing requirements on digital lenders. NGOs argue that the new tiered system should be integrated with fintech regulation to avoid regulatory arbitrage.

5. The Road Ahead

The GhanaWeb piece underscores that the debate is far from settled. The next steps involve:

- Stakeholder Consultations: A series of workshops scheduled from October to December to refine the tiered framework.

- Regulatory Drafting: The BoG’s legal team is drafting a Non‑Banking Financial Institutions (Revised) Bill that incorporates tiered provisions.

- International Collaboration: Ghana is engaging with the International Monetary Fund (IMF) and the World Bank for technical assistance in implementing a risk‑based regulatory architecture.

- Monitoring & Evaluation: An independent oversight body will monitor the impact of the new regulations on credit availability, default rates, and consumer complaints.

As the sector navigates this transformation, stakeholders will have to balance the twin imperatives of protecting consumers and maintaining financial inclusion. The outcome will likely set a precedent for other West African nations grappling with similar regulatory challenges in their micro‑finance ecosystems.

In conclusion, Ghana’s micro‑finance sector stands at a pivotal juncture. The dialogue between NGOs and the government over a tiered regulatory approach reflects a broader global trend toward risk‑based supervision. While the path forward is fraught with challenges—from implementation costs to stakeholder alignment—the potential benefits—a resilient, inclusive financial system—are compelling. The coming months will reveal whether Ghana can successfully reconcile these competing priorities and secure a sustainable future for its micro‑finance institutions and the millions of clients they serve.

Read the Full Ghanaweb.com Article at:

[ https://www.ghanaweb.com/GhanaHomePage/business/Microfinance-sector-under-scrutiny-as-NGOs-push-for-tiered-regulation-1999410 ]