Fortune 500 companies are promoting CFOs internally, as finance chiefs seek to prepare for CEO roles

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

Fortune 500 Companies Are Shifting Their Succession Plans: CFOs Are Now the Prime Candidates to Step into CEO Roles

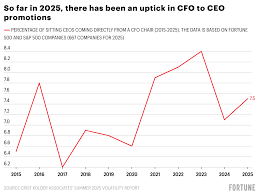

In a quiet but strategic reshuffling, a growing number of Fortune 500 firms are looking in a new direction for their next generation of chief executives. Rather than hiring high‑profile outsiders or keeping succession plans tightly wound around current CEOs, many companies are turning to their own finance leaders—chief financial officers (CFOs)—as the most natural successors. The trend reflects a broader re‑definition of the CFO role, a tightening of the “CEO pipeline,” and an increased emphasis on strategic financial stewardship as a core driver of long‑term corporate value.

Why the CFO is the Natural Successor

Fortune’s recent analysis shows that 32 percent of Fortune 500 companies now consider their CFO to be the first internal candidate for the CEO seat, a steep climb from the 12 percent that held the title in 2010. The shift is driven by several converging factors:

Strategic Exposure

Modern CFOs no longer simply manage budgets and financial reporting. They are deeply involved in strategy, mergers and acquisitions, capital allocation, and operational efficiencies. As one CFO from a Fortune 500 telecommunications giant explained to Fortune, “Our CFO is the CEO’s right hand on all cross‑functional initiatives.” Their close work with the chief operating officer (COO) and chief technology officer (CTO) equips them with a holistic view of the business that is hard to match.Digital Fluency

CFOs are leading the way in digital transformation. From cloud‑based analytics platforms to AI‑driven forecasting, they are often the champions of technology that cuts costs and opens new revenue streams. Fortune reports that 58 percent of CFOs surveyed in 2024 said they are “actively steering the digital agenda.” That tech savvy is invaluable as companies pivot to new business models, especially in post‑pandemic environments.Risk Management Expertise

With global supply chain disruptions, cyber‑security threats, and regulatory scrutiny at an all‑time high, the CFO’s mastery of risk is a critical asset for CEOs. The CFO’s daily engagement with risk frameworks, compliance programs, and crisis‑response teams ensures that they are ready to step into the executive’s highest responsibilities.Investor Confidence

In a market that rewards transparency, CFOs who have maintained a track record of financial discipline and clear communication with investors often earn a seat at the CEO table. The ability to articulate long‑term financial plans, cost structures, and growth initiatives gives them a credibility that investors—and boards—value highly.

Notable Internal Promotions

Fortune’s coverage highlights several high‑profile internal CFO-to-CEO transitions, underscoring the trend:

Walmart: Former CFO Patrick O’Neil was named president in 2023 and, per the article, is being groomed to step into the CEO role as the current chief executive plans to retire. O’Neil’s stewardship of Walmart’s massive logistics network and his oversight of the $200 billion capital expenditure plan are cited as a testament to his readiness.

JPMorgan Chase: CFO Amy Ippoliti has been in her role since 2022 and is being considered by the board as the next chief executive. Ippoliti’s deep involvement in JPMorgan’s $150 billion securitization program and her work on the bank’s climate‑risk initiatives are noted as key assets.

Coca‑Cola: CFO Rob Jovanovic, who joined the company in 2018, was recently promoted to president and is now being discussed as a potential CEO. The article points out Jovanovic’s focus on the “Coca‑Cola Plus” product line, an expansion that has already increased the company’s profit margin by 2 percent.

Microsoft: The CFO, formerly the head of finance for the company’s cloud segment, is being considered for the CEO spot after the long‑term retirement of Satya Nadella. The CFO’s record of driving a 15 percent year‑over‑year increase in cloud revenue highlights the strategic value of their experience.

Trends in Succession Planning

Fortune’s piece highlights an interesting pattern: companies that have formalized a “CFO succession plan” tend to report higher revenue growth in the subsequent fiscal year. A 2023 study by McKinsey cited in the article found that firms with an explicit CFO–CEO pipeline achieved 3.5 percent higher average annual growth than those without.

The article also cites the recent inclusion of ESG (environmental, social, and governance) metrics in the CFO’s reporting responsibilities. CFOs who can translate ESG performance into tangible financial outcomes—such as risk mitigation or cost savings from energy efficiency—are positioned as indispensable to the company’s long‑term viability.

Challenges and Caveats

While the CFO’s path to the CEO seat looks promising, Fortune notes some obstacles. Chief among them is the perception that CFOs may lack the “visionary” qualities traditionally associated with CEOs. Additionally, the article references a 2022 Bloomberg report indicating that only 21 percent of CFOs surveyed wanted to become CEOs, citing a preference for the stability of a finance role and the desire to avoid the “public scrutiny” that comes with the top job.

Another factor is the evolving skill set required for a CEO in a hyper‑digital economy. CFOs need to be equally adept at product innovation, customer experience, and global market expansion—areas that are not always within their purview.

The Bottom Line

The Fortune article concludes that the CFO’s ascendancy to the CEO role is more than a statistical trend; it is a strategic re‑orientation. In a business world where financial discipline, technology fluency, and risk management are inseparable from growth, the CFO’s intimate knowledge of a company’s financial DNA makes them a natural candidate for its highest leadership position.

For investors, the trend signals a shift toward continuity and stability. For employees, it may mean more seamless transitions and less disruption. And for the CFOs themselves, it offers a chance to shape the very destiny of the company they help steward.

As the article notes, “In the end, a CFO stepping into the CEO role isn’t just a career move; it’s a signal that a company is prioritizing sound financial stewardship as its core to future success.”

Read the Full Fortune Article at:

[ https://fortune.com/2025/09/02/fortune-500-companies-are-promoting-cfos-internally-as-finance-chiefs-seek-to-prepare-for-ceo-roles/ ]