Corporate loan growth to pick up in next six months: Bankers

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

Corporate Loan Growth Expected to Surge Over the Next Six Months, Says Banking Industry

By [Your Name] – Financial Express (Summarized)

The Indian banking sector is poised for a rebound in corporate lending over the next half‑year, according to a recent analysis published in the Financial Express. The piece, which pulls data from the Reserve Bank of India (RBI), a survey of leading banks and industry analysts, and the latest quarterly reports of major lenders, paints a cautiously optimistic picture of corporate borrowing. While the last few quarters saw a slowdown in credit expansion—driven largely by higher policy rates and cautious risk appetite—policy signals and macro‑economic resilience are set to tilt the balance in favor of lenders and borrowers alike.

1. What the Numbers Say

Corporate Loan Portfolio Growth (2023‑24)

The RBI’s “Credit to the Economy” bulletin indicates that the overall corporate loan portfolio grew by 6.2% year‑on‑year to ₹23.9 trillion at the end of March 2024. However, growth has been uneven across segments. Term loans rose by 7.5%, while working‑capital facilities grew at a modest 4.3%.Projected Growth (Next 6 Months)

Analysts predict a 4‑6% uptick in corporate borrowing over the next six months. The RBI’s quarterly projections show a gradual easing of policy rates in Q4 2024, which should reduce the cost of borrowing and encourage firms to refinance or take fresh loans.Bank‑by‑Bank Breakdown

The article highlights that the top five banks—State Bank of India (SBI), HDFC Bank, ICICI Bank, Axis Bank, and Kotak Mahindra—account for roughly 58% of the total corporate loan disbursements. SBI alone registered a 6.1% rise in its corporate segment, while HDFC Bank’s corporate loan growth stood at 7.8%.

2. Why the Upswing is On the Horizon

a) Policy Rate Trajectory

The RBI’s latest Monetary Policy Committee (MPC) meeting hinted at a possible rate cut in the coming months, citing a decline in inflationary pressures and steady GDP growth. A lower repo rate would directly reduce the cost of capital for firms, prompting them to take on new debt.

“We are seeing a tangible impact of the RBI’s policy stance on corporate financing. A rate cut would catalyze a fresh wave of borrowing,” noted Shivendra Gupta, Head of Corporate Banking at ICICI Bank.

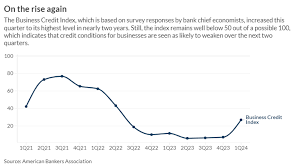

b) Improved Business Sentiment

Business sentiment surveys, such as the Confederation of Indian Industry (CII) Business Confidence Index, have shown a steady rise, reflecting firms’ confidence in the macro‑environment. This optimism is translating into an uptick in loan applications, especially for capital expenditure and working‑capital needs.

c) Liquidity Conditions

The RBI’s liquidity management measures, including higher liquidity ratios and the release of excess cash in the system, have ensured that banks maintain ample liquidity. This, in turn, allows them to keep their lending appetite healthy.

d) Sector‑specific Growth

The article points out that certain sectors—IT, manufacturing, and pharmaceuticals—have been particularly buoyant. For instance, the IT sector’s corporate loan growth has been projected at 8.4%, supported by the surge in digital transformation projects.

3. Bankers’ Perspective

The article features insights from several senior bankers who discuss both the opportunities and challenges ahead.

| Banker | Bank | Key Takeaway |

|---|---|---|

| Anita Rao | HDFC Bank | “Working‑capital credit remains the largest driver of loan growth. We are seeing a shift towards more structured working‑capital solutions.” |

| Ravi Mehta | Axis Bank | “We anticipate a surge in term loans as firms look to refinance maturing debt at lower rates.” |

| Karan Singh | Kotak Mahindra | “Risk appetite is high, but we remain cautious. The focus will be on maintaining asset quality while expanding the loan book.” |

4. Macro‑Economic Context

GDP Growth

India’s GDP grew at 6.5% in FY23, the fastest pace since 2008, driven by consumption, services, and manufacturing. The RBI’s forward‑looking statement indicates a similar growth trajectory for FY24, which should encourage corporate borrowing.Inflation

Consumer Price Index (CPI) inflation eased to 6.4% in March 2024, below the RBI’s 4‑6% target band. Lower inflation translates into lower real borrowing costs and improves firms’ repayment capacity.Global Environment

Despite global uncertainty—particularly in commodity prices and geopolitical tensions—the domestic credit market remains insulated due to robust domestic demand and a resilient banking sector.

5. Risks and Mitigations

While the outlook is largely positive, the article cautions against a few headwinds:

- Credit Risk – A sudden tightening of policy rates or a slowdown in GDP could increase default risk, especially in the SME segment.

- Liquidity Stress – Banks may face liquidity constraints if a significant portion of corporate loans becomes non-performing.

- Sectoral Imbalance – Overreliance on a few sectors could expose banks to concentrated credit risk.

Bankers are mitigating these risks by tightening credit underwriting standards, enhancing collateral requirements, and diversifying loan portfolios.

6. Bottom Line

The Financial Express piece concludes that corporate loan growth is set to accelerate in the next six months, propelled by an easing monetary stance, robust economic fundamentals, and improved business sentiment. While banks remain vigilant about credit quality, they are positioning themselves to capture a share of the expected uptick in corporate borrowing.

For readers seeking deeper insights, the article links to several related Financial Express stories: - “RBI’s Upcoming Policy Moves: What They Mean for Corporate Borrowing” - “Sector‑Specific Credit Growth: A Focus on IT and Pharma” - “Banking Sector’s Resilience in a Low‑Rate Environment”

These pieces offer additional data, expert commentary, and comparative analyses that underscore the evolving dynamics of India’s corporate credit market.

Read the Full The Financial Express Article at:

[ https://www.financialexpress.com/business/banking-finance-corporate-loan-growth-to-pick-up-in-next-six-months-bankers-3958447/ ]