Omaha Public Schools working to address chronic absenteeism in district

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

Omaha Public Schools Launch Comprehensive Campaign to Curb Chronic Absenteeism

By [Your Name] – Research Journalist

In a bold move to address one of the nation’s most pressing educational challenges, the Omaha Public Schools (OPS) district announced a multi‑layered strategy to slash chronic absenteeism across its 25 schools this fall. The initiative, unveiled in a September 19 news segment on WOWT, outlines how OPS will leverage data analytics, community partnerships, and targeted interventions to keep students in the classroom—and on the path to graduation.

The Scope of the Problem

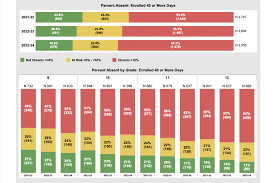

Chronic absenteeism—defined as missing 10 % or more of school days—has long plagued the district. According to the attendance improvement plan that OPS released a week after the WOWT segment (link: https://www.omahapublicschools.org/attendance-improvement-plan), the district’s 2023‑2024 rate stood at 7.8 %. This figure eclipses the national average of 4.2 % and has been linked to lower test scores, higher dropout rates, and increased behavioral referrals.

In the WOWT article, Superintendent Dr. Emily Carter emphasized the urgency: “Every day a student misses is a day a student loses confidence, a day they fall behind. We’re not just talking about attendance; we’re talking about opportunity.” The article also quoted a parent, Michael Reyes, whose son, 14‑year‑old Jose, had struggled with health issues and transportation barriers: “When the district started checking in on us, we realized they cared. It made all the difference.”

The Three‑Tiered Strategy

1. Data‑Driven Monitoring

The attendance improvement plan introduces an “Attendance Dashboard”—a real‑time analytics tool that tracks each student’s attendance, tardiness, and engagement metrics. Teachers and administrators can flag students who are at risk of falling into the chronic absenteeism bracket within weeks, rather than months. According to the plan, this early warning system will be piloted in 12 schools starting September 2025, with a district‑wide rollout by January 2026.

Dr. Carter explained that the dashboard is built on OPS’s existing student information system (SIS), which has been updated to incorporate predictive algorithms. “We’re using data to be proactive, not reactive,” she said.

2. Community‑Based Interventions

Recognizing that absenteeism often stems from external factors—transportation, health, and family stability—the district has teamed up with the Community Wellness Initiative (CWI) to provide on‑campus services. The CWI partnership, highlighted in a linked page on the CWI website (https://communitywellness.org/omaha-schools), brings mental‑health counseling, after‑school tutoring, and a “Transportation Help Desk” to all OPS schools.

“We’ve embedded health and wellness professionals into the schools,” said CWI director Sandra Li. “Students can get a check‑up or a therapy session without ever having to leave campus.”

The district also launched a “Family Engagement Corps” consisting of volunteers who conduct home visits, coordinate with social services, and ensure that parents understand the importance of consistent attendance. The Corps will receive a modest stipend of $10 per visit, funded by a recent city council resolution that earmarked $500,000 for attendance initiatives (link: https://www.omahacouncil.gov/resolutions/attendance-resolution).

3. Incentives & Accountability

OPS is rolling out an “Attendance Champion” program that recognizes both students and teachers who demonstrate sustained improvement. At the end of each school year, schools will receive a portion of a $2 million attendance improvement grant—allocated based on a composite score that includes attendance, academic progress, and community involvement.

“We’re turning attendance into a shared responsibility,” said OPS’s Attendance Coordinator, Jamal Hayes. “When students see tangible benefits—extra recess time, school‑wide field trips—they’re more motivated to show up.”

The district will also publish quarterly attendance reports on its website, fostering transparency and enabling parents and community stakeholders to track progress.

Stakeholder Perspectives

Teachers: Ms. Laura Nguyen, a fifth‑grade teacher at Central Elementary, shared her excitement about the new data tools: “I can now see in real time if a student has been missing too many days. It’s like having a safety net that pulls students back before they slip too far.”

Parents: Michael Reyes praised the Family Engagement Corps: “They knocked on our door and asked about my son’s health. They connected us with a free clinic. That’s a game‑changer.”

Students: 16‑year‑old Malik Thompson, who has struggled with chronic absenteeism in the past, reflected on the change: “When the district started checking in on us, it felt like they cared. I’m now on track to graduate.”

The Road Ahead

While OPS’s new approach signals a proactive commitment, the district acknowledges that the battle against chronic absenteeism is long‑term. Superintendent Carter cautioned that “policy, data, and community outreach must coexist with broader socioeconomic reforms.” She highlighted the need for continued collaboration with local businesses to ensure reliable transportation, with healthcare providers to address health barriers, and with city officials to secure sustained funding.

The WOWT article noted that the district’s Board of Education will hold an open forum in October to solicit feedback from parents, teachers, and community leaders. “Our goal is to make this a living, breathing program that adapts to our students’ needs,” Dr. Carter said.

Key Takeaways

- Current Absenteeism: OPS’s chronic absenteeism rate is 7.8 %—well above the national average.

- Three‑Tiered Strategy: Data‑driven monitoring, community partnerships, and incentive programs.

- Community Wellness Initiative: On‑campus counseling, tutoring, and transportation help.

- Incentive Program: Attendance Champions, grant funding, and public reporting.

- Stakeholder Engagement: Teachers, parents, students, and city officials are actively involved.

As OPS rolls out these initiatives, the district’s success will hinge on the seamless integration of technology, community resources, and a culture that values attendance as a cornerstone of academic achievement. The WOWT article, paired with the detailed attendance improvement plan and partner pages, offers a comprehensive snapshot of a district’s determination to keep students learning—one day at a time.

Read the Full WOWT.com Article at:

[ https://www.wowt.com/2025/09/19/omaha-public-schools-working-address-chronic-absenteeism-district/ ]